•

Start of a shallow rate cycle

post February cuts.

• Investors should add duration

with every rise in yields, as

yield upside limited.

•

Mix of 10-year maturity and 1-

5-year corporate bonds are

best strategies to invest in the

current macro environment.

•

Selective Credits continue to

remain attractive from a risk

reward perspective given the

improving macro fundamentals.

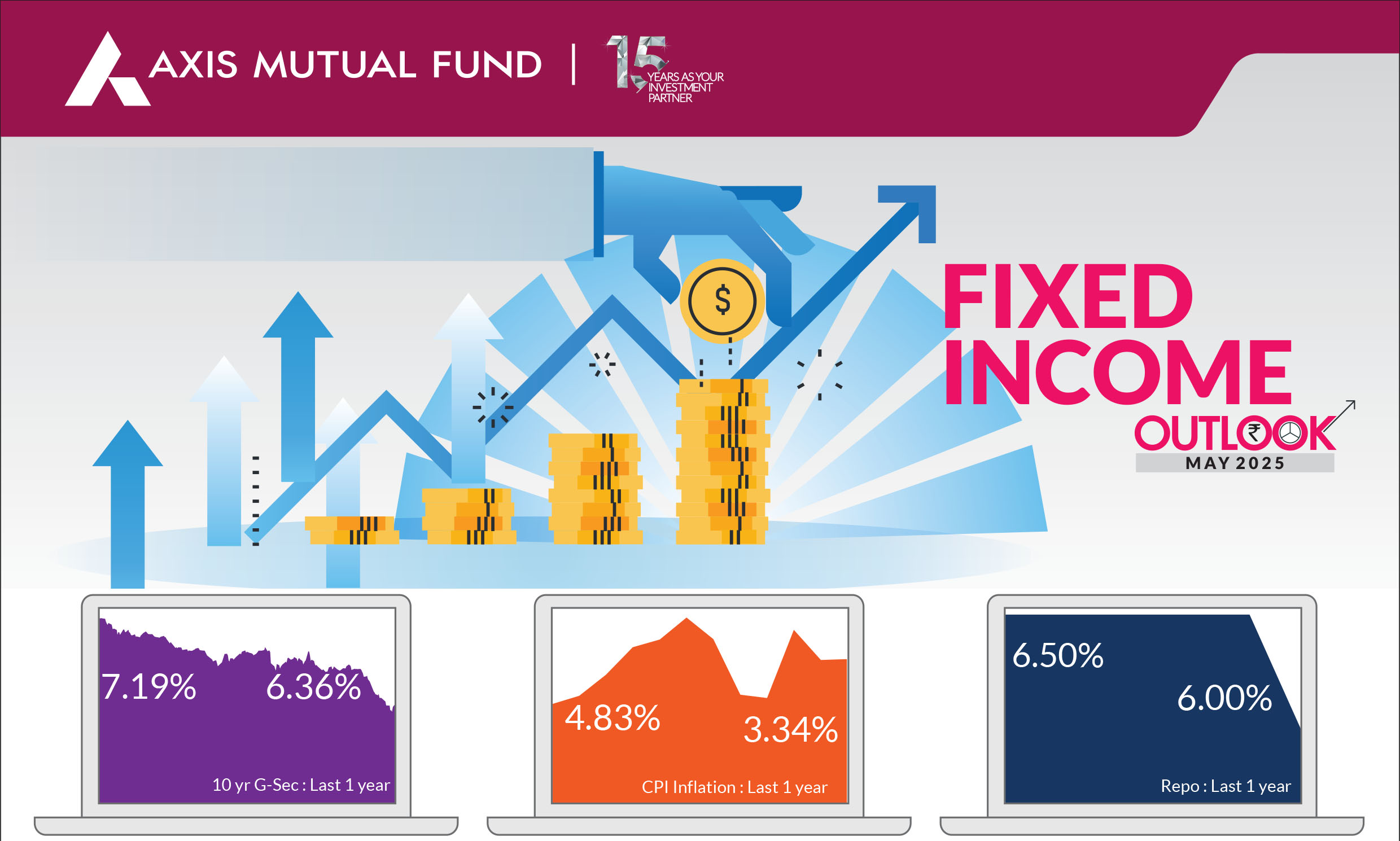

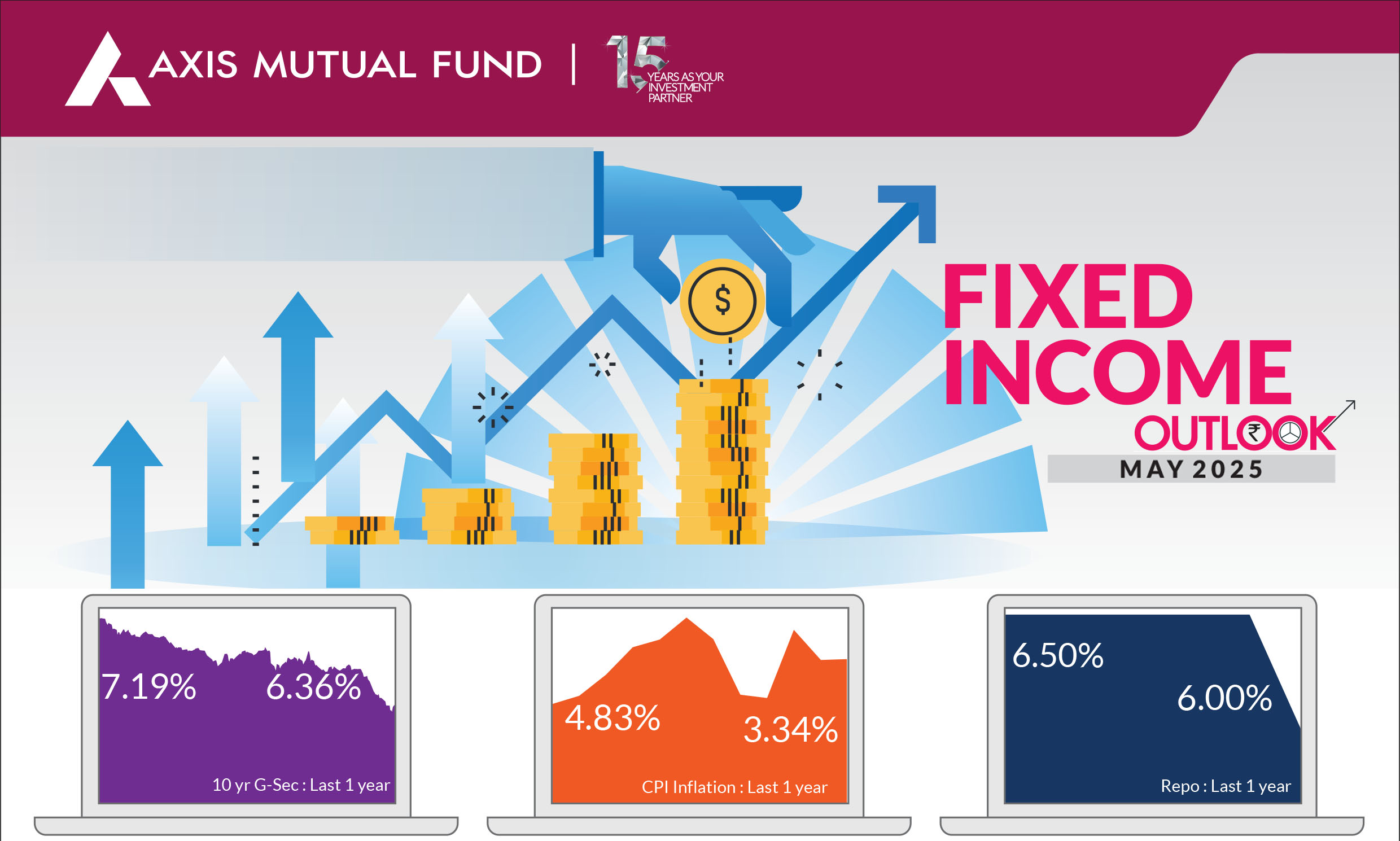

The US Treasury market witnessed volatility with yields initially declining and then moving up sharply as a result of reciprocal tariffs imposed by the US on all countries. Overall, 10 year Treasuries ended 4 bps higher at 4.16. In India, the 10-year government bond yields ended 23 basis points higher at 6.36% given the repo rate cut, liquidity infusion by the central bank and receding inflation numbers.

RBI infuses liquidity, lower rates :

The central bank continues to infuse liquidity into the

system by way of open market operations(OMOs) worth Rs 125,000 cr in May. Earlier,

in April the Reserve Bak (RBI) had infused Rs

80,000 cr in the system. Meanwhile, in April,

the Monetary Policy Committee (MPC) of the

RBI lowered the repo rate by 25 basis points

to 6.0% - its second consecutive rate cut.

More importantly, the RBI changed its stance

from neutral to "accommodative", supported

unanimously by all committee members. This

decision comes against a backdrop of global

uncertainty given the tariffs implemented by

the US government across countries leading to a sell-off in equities globally and weak

sentiment. The central bank's change in stance is suggestive of proactively supporting

growth given the challenges that could be faced in such an environment and could imply

a deeper rate cut cycle.

With the announcement of RBI dividend this month, we expect banking liquidity to be approx. Rs 6 trn. Such high banking liquidity could lead to higher rally at the short end of the curve.

Meanwhile, the RBI relaxed liquidity coverage ratio (LCR) guidelines, which is expected to enhance credit availability and support growth in the banking and financial sectors.

With the announcement of RBI dividend this month, we expect banking liquidity to be approx. Rs 6 trn. Such high banking liquidity could lead to higher rally at the short end of the curve.

Meanwhile, the RBI relaxed liquidity coverage ratio (LCR) guidelines, which is expected to enhance credit availability and support growth in the banking and financial sectors.

Inflation falls below 4% :

Headline inflation fell to a 6 year low of 3.3% in March from

3.6% in February 2025, led by a faster than expected moderation in food prices

especially vegetables with the onset of winter months. Food inflation, a key component

of CPI also eased to 2.7% in March from 3.8% in February 2025. Core inflation

continues to remain below 4% for over 12 months. We anticipate headline inflation to

remain low due to good rabi and kharif crop harvests and lower vegetable prices.

Rupee continues to appreciate in April : The rupee appreciated approx. 1% in April vis a vis the US dollar on account of foreign inflows in April and a weaker dollar itself which lost ground against most currencies. This level is rupee's highest in 2025. The US dollar lost 3% in April and around 5% in 2025 year to date.

US treasury yields narrow in April : While yields on US Treasuries narrowed by 4 bps over the month, the volatility around reciprocal tariffs and the uncertainty thereof led to swings in bond yields. Within a week, the yields rose to 4.50% from 4% levels after the announcement on tariffs by the US administration.

Rupee continues to appreciate in April : The rupee appreciated approx. 1% in April vis a vis the US dollar on account of foreign inflows in April and a weaker dollar itself which lost ground against most currencies. This level is rupee's highest in 2025. The US dollar lost 3% in April and around 5% in 2025 year to date.

US treasury yields narrow in April : While yields on US Treasuries narrowed by 4 bps over the month, the volatility around reciprocal tariffs and the uncertainty thereof led to swings in bond yields. Within a week, the yields rose to 4.50% from 4% levels after the announcement on tariffs by the US administration.

Market view

After the reciprocal tariffs imposed initially, the US government has given a 90 day pause across countries and most countries including India are utilizing this opportunity for better terms of negotiation. This is what we had mentioned initially that the US may want to negotiate the terms of trade to bring down its trade deficit with its key trading partners. Having said that, one thing remains certain - the uncertainty on tariffs and its impact on global growth. The US will see its growth slowdown and we expect the US Fed to lower interest rates by another 50-75 bps. However, the tariffs could lower growth and this could mean rate cut cycle of 75-100 bps.India too will witness slower growth but what holds the country in good stead is limited goods exports to the US, but the services exports to the US is a higher component (9.4% of GDP). The 90-day pause, while giving near-term respite, extends trade policy uncertainty, which could weigh down investment and consumption.

On the macro side, inflation has slowed down and more than inflation, growth is the worry for the central bank. In its last monetary policy, RBI prioritized growth and is likely to support economy proactively. This combination of liquidity, rate cut and change in stance will keep the bond market happy. Rate cuts of 50 bps have been delivered so far and we expect another 25 bps in June and a pause thereafter. However, if the tariffs linger for long we could see further cuts of 25-50 bps.

A significant part of the bond market rally is behind us, incremental rate cuts and OMO's announcements would lead to near term rally in bond yields. Also, as per macro indicators like GDP, CPI which we believe would remain soft for FY26, there is nothing that can lead to significant upside in yields. Historically we have witnessed a 100-125 basis points bond rally in an easing cycle. We have already seen yields lower by 70-75 bps over last 12 months. Hence we expect limited rally from hereon. Once there is a resolution on US tariffs, and if they are significantly rolled back, the rally in India bond markets will likely be done. This is because clarity will emerge on CPI, and one will be able to gauge the impact on growth and start pricing terminal rate cut. Given the surplus liquidity, we expect the short bonds to outperform longer duration.

Risks to our view: The risks to our view at this point are as below

1) Currency risk

2) Trade wars

Strategy - We have been maintaining a higher duration across all our funds and guiding the rally in bonds since March 2024. We have already witnessed more than 80 bps of rally in 10-year bonds since early 2024. Although positive demand-supply dynamics for government bonds and expected rate cuts will continue to keep bond markets happy, from hereon we expect a limited rally in the next 3-6 months. Directionally we see yields for the 10-year Gsec to trade in a range of 6.15%-6.25% in the next 6 months. Corporate bond yield for AAA rated firms for notes due in 3-10 years will trade in a band of 6.50% and 6.75%.

We anticipate that the RBI will maintain its emphasis on ensuring positive system liquidity going forward. Due to favourable demand supply dynamics and OMOs, we continue to have a higher bias towards government bonds in our duration funds.

Going forward, we believe it's time to add 1-5 year corporate bonds to the portfolio as we expect surplus banking liquidity, lower supply of corporate bonds/ CDs due to slowdown and delay in implementation of LCR guidelines and attractive spreads and valuations. Incrementally short bonds can outperform long bonds from risk risk-reward perspective due to a shallow rate cut cycle, lower OMO purchases in the second half of the year and a shift in focus to Govt Debt to GDP targets.

What should investors do?

• In line with our core macro view, we continue to advise short- to medium-term funds with tactical allocation of gilt funds to our clients.

Source: Bloomberg, Axis MF Research.